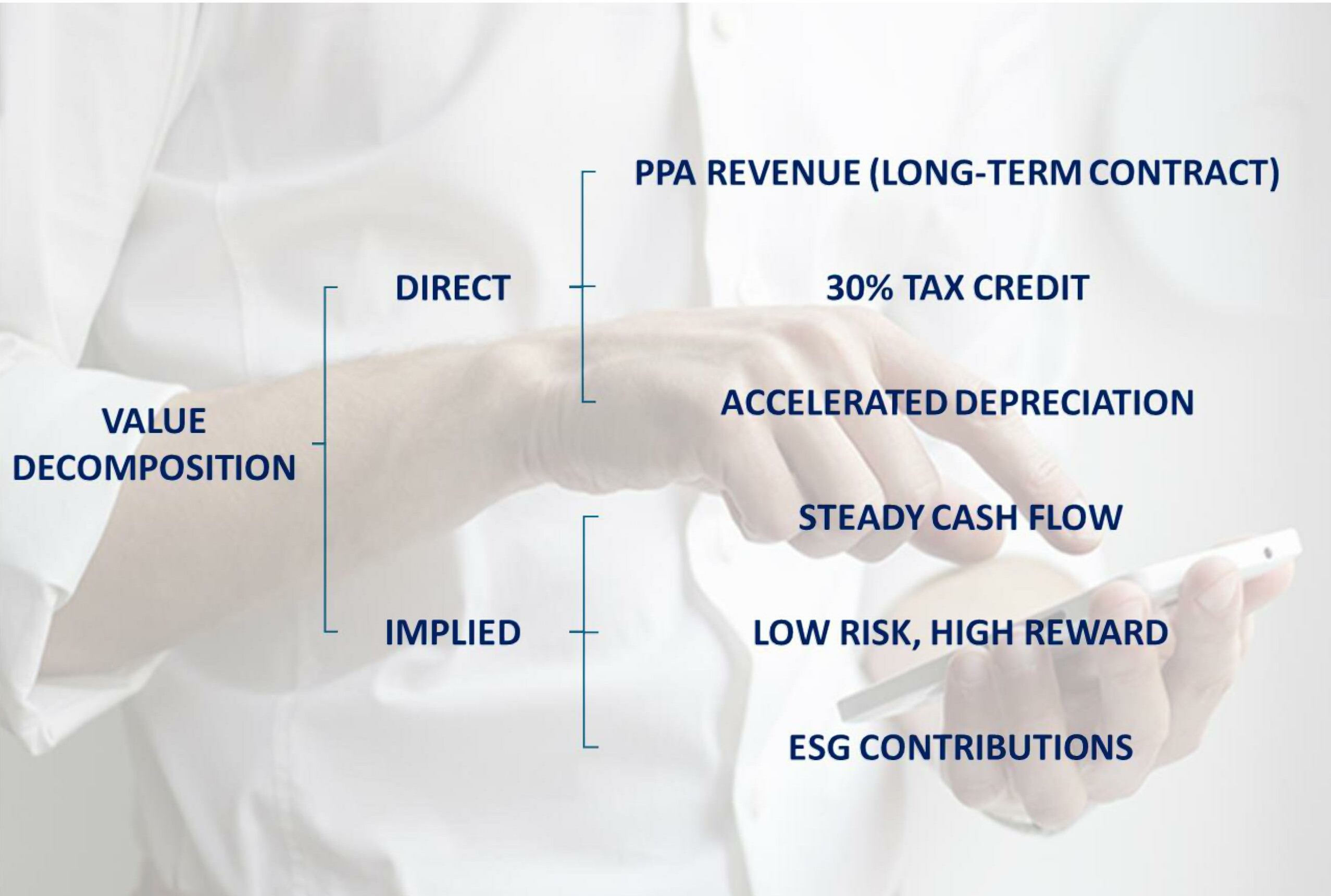

- Investments aligned to steep incentives from federal and state

- Cash flow commitment backed by long-term contracts (25 years) and credible clientele

- Limited Partners (LPs) receive higher priority on returns.

- Flexibility to deploy pre-tax SDIRA funds for ~1.5x traditional gains

- Diversification across a portfolio of assets reduces risk

- Opportunity to invest in hard assets that have steady production and revenue stream

- Performance tuning, predictive maintenance and insurance are part of fund operations

- Provision for end customers to participate as Limited Partners further confirming the success of asset deployment

- Opportunity to re-invest in future funds

STABILITY

- Less volatile than the stock market

- Less risk than real estate or debt funds